Cloud Computing Overview

The shift to cloud computing has created new opportunities for investment and innovation, like the shift from centralized mainframe computers to the current distributed model with the advent of personal computers which both HH and myself were fortunate to witness and were part of the change. We believe and we are seeing the move to cloud computing has resulted in a significant wave of technological innovation in areas such as Cloud networking infrastructure, Cloud applications, Cloud storage, Cloud services, and Cyber security. The pandemic has accelerated the adoption of cloud computing, with an increasing number of companies and corporations shifting their IT infrastructure to the Cloud. We believe that the cloud business segment will continue to grow at a rapid pace. Over 98% of organizations use the cloud in some way, and cloud infrastructure spending is estimated to increase by 23% in 2023.

Cloud Computing Statistics for 2023

According to AAG IT services:

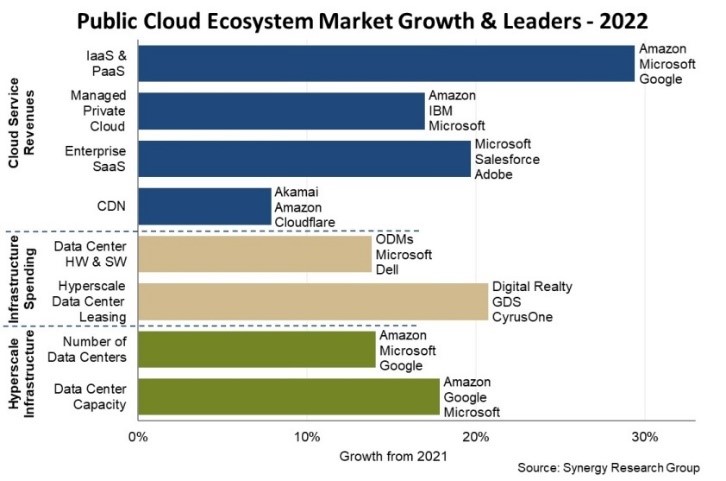

- 12-month revenues between the start of 2021 and 2022 for cloud infrastructure services reached $191 billion.

- Public cloud Platform-as-a-Service revenue in 2022 was $111 billion.

- The cloud market is projected to be worth $376.36 billion by 2029.

- It’s estimated that the world will store 200 zettabytes in the cloud by 2025.

Cyber Security In Business

Security is a critical consideration for businesses looking to enter the cloud. Up to 45% of data breaches occur in the cloud, with higher costs for those who hadn’t developed a proper cloud security plan. The global cloud security software market was valued at $29.5 billion in 2020. By 2026, the market is expected to be worth $37 billion.

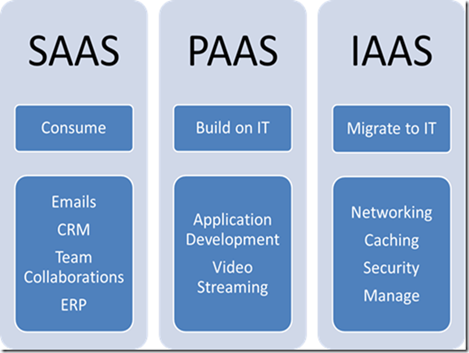

Gartner has forecasted that end-user spending on public cloud services will grow by 20.7% to reach $591.8 billion in 2023, up from $490.3 billion in 2022. The forecast indicates that infrastructure-as-a-service (IaaS) will experience the highest growth rate of 29.8% in 2023. Other segments like platform-as-a-service (PaaS) and software-as-a-service (SaaS) are also expected to see growth, with Gartner forecasting growth rates of 23.2% and 16.8% respectively for 2023.