Objective of Fund

SiS SPAC Investment Fund (“SiS SPAC Fund”) objective is to achieve a positive risk adjusted return by investing in publicly traded securities, such as units, common stock, warrants and rights in Singapore, Hong Kong, USA and other global Stock Exchanges, issued by SPACS formed for the purpose of raising capital to fund an initial business combination (IBC), through a merger, capital stock exchange, asset acquisition or other transformative transactions, of one or more operating businesses or assets that are typically not publicly listed.

Investment Philosophy

SiS SPAC Fund invests only in SPACs that deposit 100% of money raise in Trust Account while offering warrant per SPAC’s unit. We invest with SPACs’ sponsor with proven value creation track record, with experience in M&A, track record, or senior executives from listed companies. If a SPAC proposed merger is deem overvalued, sell the units or redeem at cost while retaining the attached warrant.

What is a special purpose acquisition company (“SPAC”)?

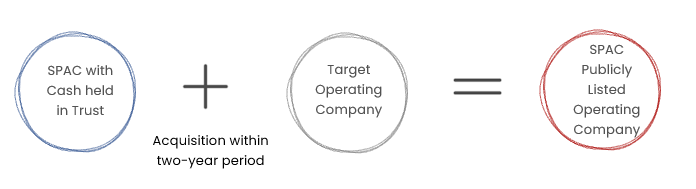

SPAC is a company that has no commercial operations, instead is formed with the purpose to raise capital through an Initial Public Offering (“IPO”) which is used to acquire or merge with target companies. Also known as “blank check company”, SPACs are typically set up by experienced and reputable investors, individuals or institutions. SPAC Provides private companies with unique access to public markets, while offering investors a co-investment opportunity alongside the best-in-class sponsors. A SPAC is designed to create value by bringing target companies to the financial market quickly, bypassing time-consuming and complicated listing processes of the stock exchange that it will be listed.

SPAC sponsors ideally comprise of successful entrepreneurs, well-known private equity funds and/or firms. All of which have the experience, reputation and expertise in identifying, acquiring and operating businesses and running of public companies. SPAC Investors range from institutions, private equity funds, accredited and retail investors. Typically, SPAC sponsors have a two-year period to identify and complete an acquisition or merger, else are required to return funds to investors.

SPAC have been successful on established bourses such as Nasdaq, New York Stock Exchange, Hong Kong Stock Exchange and Singapore Stock Exchange. The prospect of success for a SPAC is heavily reliant on the expertise of its sponsor to identify suitable and prospective unlisted companies and their ability to unlock value for investors by listing such companies quickly on a bourse.

How Does a SPAC Work ?

Popularity of SPACs in the U.S.

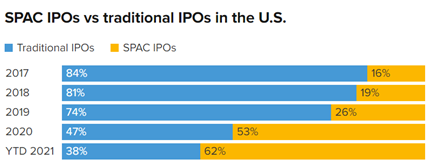

- SPACs have been around for decades in the U.S. But their popularity has soared in recent years, and they’ve exploded in popularity over the past year as an alternative way for private businesses to list on stock exchanges.

- SPAC allows private businesses to bypass the traditional IPO route which can be a time-consuming and complicated process.

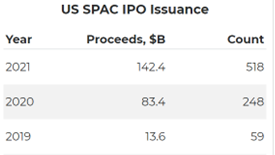

- By Nov 4, 2021, around 518 SPACs have gone public, totaling US$142.4 billion in capital raised, exceeding 2020’s record of US$82 billion.

How does the SPAC Fund Meet Accredited Investor’s Needs?

Short Investment Time Frame

- Each SPAC investment has a 2-year time frame for the successful IPO of the target company after which monies will be returned to the SPAC Fund.

Alignment of Interest

- Investors’ interest aligned through the General Partner commitment

Downside Protection, Upside Opportunities

- No obligation to subscribe to shares of target company while still eligible for warrant allocation

Regulated Platform

- The Fund is regulated by the Monetary Authority of Singapore and complies with the Singapore’s Securities and Futures Act (2001)

About the SPAC Fund Manager

The Manager of the Fund is SiS Asset Management Pte Ltd (“SiSAM”)

(http://www.sisasset.com/), a fully-owned subsidiary of SiS International Holdings Limited and one of four key pillars of growth of SiS International Holdings Limited.

SiS International Holdings Limited (https://sis.com.hk/) was founded in 1983 and is listed on the Main Board of the Hong Kong Stock Exchange since 1992.Its management team comprises highly experienced professionals with a strong track record in IT, financial, investment and real estate industries.

SiS International has proven product expertise in the technology realm as evidenced by their track record of listings on the Hongkong Stock Exchange, the Thailand Stock Exchange, the Dhaka and the Chittagong stock exchanges.

SiSAM is a Registered Fund Management Company (“RFMC”) regulated by the Monetary Authority of Singapore (“MAS”).

The SPAC Fund Manager will invest in a SPAC sponsor with proven value creation track record, and experience in M&A. The SPAC Fund will only invest in SPACs with proceeds raised in a Trust Account and offer warrant per SPAC’s unit. If a SPAC proposed merger is deem over-valued, the SPAC Fund will sell the units or redeem at cost while retaining the attached warrant.